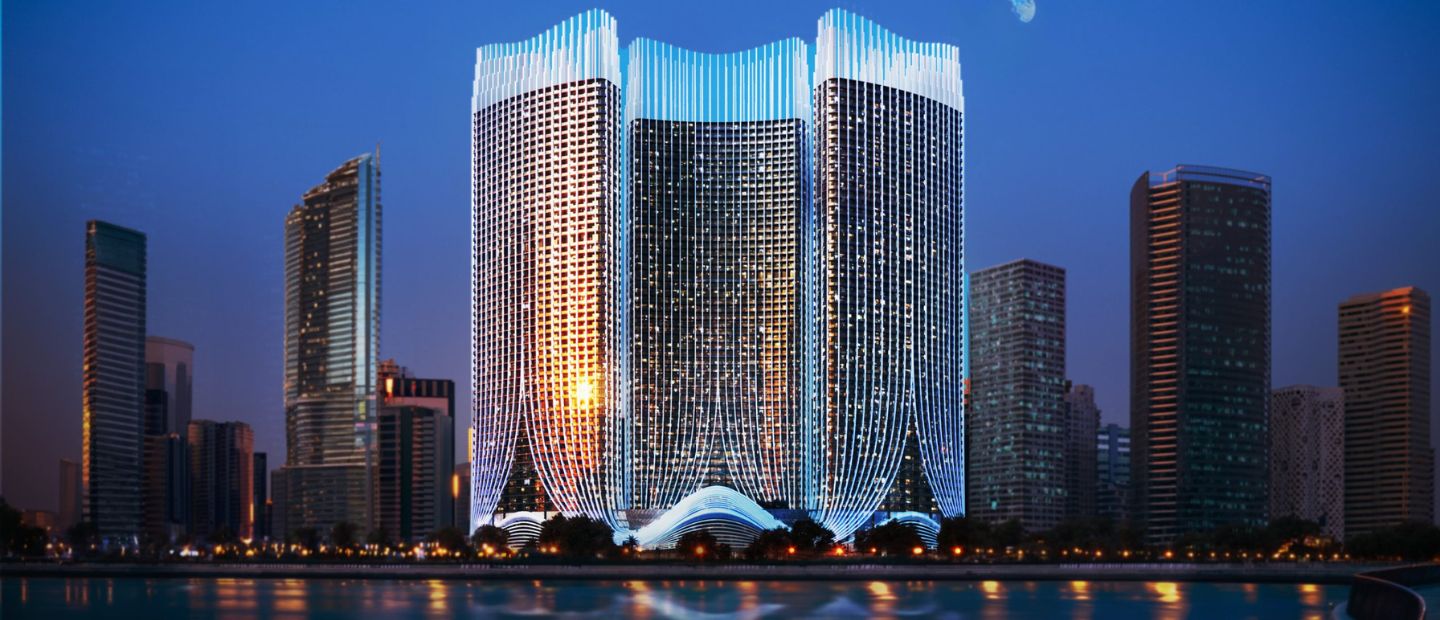

Azizi Leily

687H+MQ9 - Al Jadaf - Dubai - United Arab Emirates

Azizi Leily Description

In the heart of Al Jaddaf, where the Dubai Creek shimmers beneath the skyline, Azizi Leily rises with distinction and grace. From chic studios and spacious one- and two-bedroom residences to two signature penthouses, every home embodies refined contemporary living.

Unmatched connectivity places you minutes from Dubai’s most sought-after destinations — Downtown, Dubai Creek, the airport, business hubs, and cultural landmarks — seamlessly linked by metro, major highways, and creek ferries.

FAQs regarding Azizi Leily

-

What is the process of buying a home from start to finish?

The home-buying process typically begins with assessing your financial situation and getting pre-approved for a mortgage. Once you know your budget, you can start searching for properties that meet your needs and preferences. After finding a suitable home, you’ll make an offer, and if it’s accepted, you'll enter into a purchase agreement.

Next comes the home inspection, appraisal, and final mortgage approval. Once all contingencies are cleared and the paperwork is completed, you’ll attend the closing meeting to sign documents and transfer ownership. After closing, the keys are yours and the home officially becomes yours.

-

How much should I budget for closing costs?

The home-buying process typically begins with assessing your financial situation and getting pre-approved for a mortgage. Once you know your budget, you can start searching for properties that meet your needs and preferences. After finding a suitable home, you’ll make an offer, and if it’s accepted, you'll enter into a purchase agreement.

Next comes the home inspection, appraisal, and final mortgage approval. Once all contingencies are cleared and the paperwork is completed, you’ll attend the closing meeting to sign documents and transfer ownership. After closing, the keys are yours and the home officially becomes yours.

-

Do I need to get pre-approved before starting my home search?

The home-buying process typically begins with assessing your financial situation and getting pre-approved for a mortgage. Once you know your budget, you can start searching for properties that meet your needs and preferences. After finding a suitable home, you’ll make an offer, and if it’s accepted, you'll enter into a purchase agreement.

Next comes the home inspection, appraisal, and final mortgage approval. Once all contingencies are cleared and the paperwork is completed, you’ll attend the closing meeting to sign documents and transfer ownership. After closing, the keys are yours and the home officially becomes yours.

-

What’s the difference between a fixed-rate and an adjustable-rate mortgage?

The home-buying process typically begins with assessing your financial situation and getting pre-approved for a mortgage. Once you know your budget, you can start searching for properties that meet your needs and preferences. After finding a suitable home, you’ll make an offer, and if it’s accepted, you'll enter into a purchase agreement.

Next comes the home inspection, appraisal, and final mortgage approval. Once all contingencies are cleared and the paperwork is completed, you’ll attend the closing meeting to sign documents and transfer ownership. After closing, the keys are yours and the home officially becomes yours.

-

How long does it typically take to close on a property?

The home-buying process typically begins with assessing your financial situation and getting pre-approved for a mortgage. Once you know your budget, you can start searching for properties that meet your needs and preferences. After finding a suitable home, you’ll make an offer, and if it’s accepted, you'll enter into a purchase agreement.

Next comes the home inspection, appraisal, and final mortgage approval. Once all contingencies are cleared and the paperwork is completed, you’ll attend the closing meeting to sign documents and transfer ownership. After closing, the keys are yours and the home officially becomes yours.